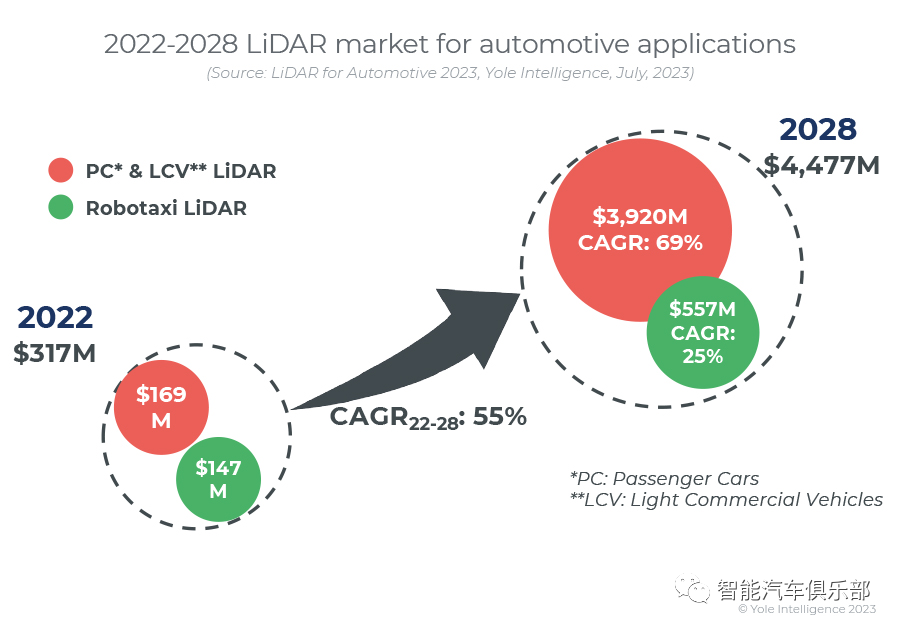

Yole Group 旗下的 Yole Intelligence 发布了《2023年全球车载激光雷达市场与技术报告》。《报告》指出全球汽车 LiDAR 市场预计将从 2022 年的 3.32 亿美元增长到 2028 年的 46.5 亿美元。

《报告》指出:

2022 年,激光雷达正处于十字路口,因为这两个市场产生的收入几乎相同:乘用车为 1.69 亿美元,机器人出租车为 1.63 亿美元。

In 2022, we are at a crossroads as these two markets generated almost the same revenue: $169M for passenger cars and $163M for robotaxi.

这两个市场的增长潜力有所不同:乘用车 2022 年至 2028 年间的复合年增长率为 69%,而同期机器人出租车的复合年增长率为 28%。

Growth potential differs for these two markets: a 69% CAGR between 2022and 2028 for passenger cars compared to a 28% CAGR for robotaxi in the same period.

由于市场还很年轻,市场份额正在迅速变化

MARKET SHARES ARE CHANGING RAPIDLY AS THE MARKET IS STILL YOUNG

汽车激光雷达(PC&LCV和Robotaxi)生态系统仍然相当庞大,Yole监测到的公司就有50家。其中一些已经实现量产,而另一些仍处于研发阶段,正在研究下一代激光雷达。

The automotive LiDAR (PC&LCV and robotaxi) ecosystem is still quite large, with 50 companies monitored. Some are already in mass production, while others are still in the R&D phase and working on the next generations of LiDAR.

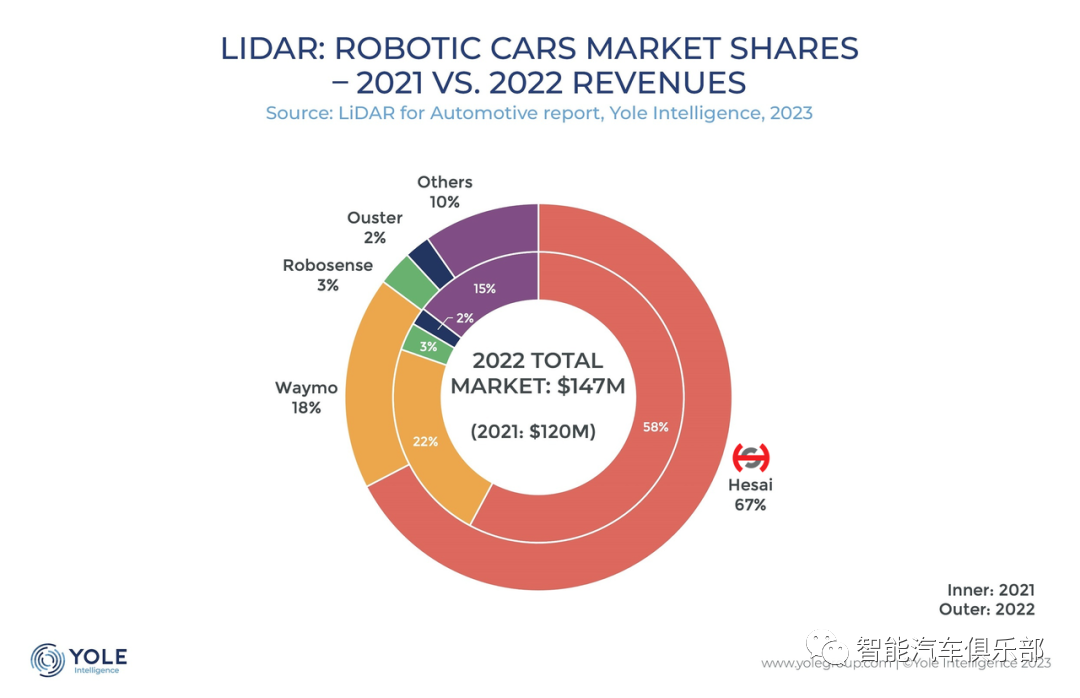

关于Robotaxi市场,很少有玩家能产生可观的收入。禾赛(Hesai)以67%的市场份额控制着市场,因为他们的激光雷达可以在大多数Robotaxi中找到,如Cruise、Aurora、Apollo、滴滴、Pony.ai和AutoX。

Regarding the robotaxi market, few players are generating significant revenue. Hesai controls the market with 67% of the market share as their LiDAR can be found in most robotaxis, such as Cruise, Aurora, Apollo, DiDi, Pony.ai, and AutoX.

事实上,禾赛取代了此前引领该市场的Velodyne。

Indeed, Hesai replaced Velodyne, which previously led this market.

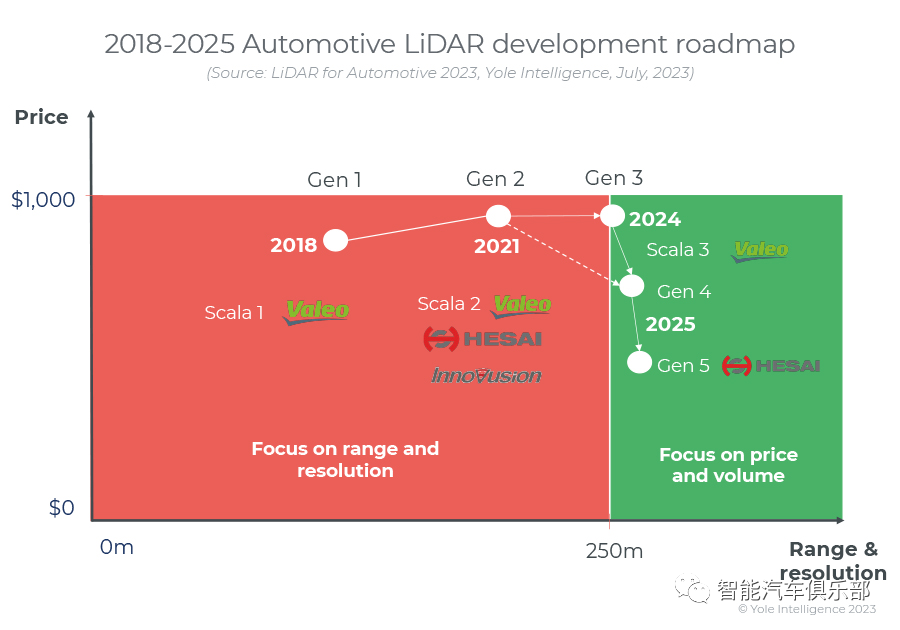

在PC和LCV市场,情况正在迅速发展,预计在未来几年将再次发生变化。自2018年以来,法雷奥(Valeo)一直是市场上的明显领导者,它与奥迪、本田和梅赛德斯的合作,为他们提供了大部分配备激光雷达的汽车。

In the PC&LCV market, things are evolving rapidly and are expected to change again in the coming years. Since 2018, Valeo has been a clear leader in the market as they supplied most of the cars released with LiDAR, thanks to partnerships with Audi, Honda, and Mercedes.

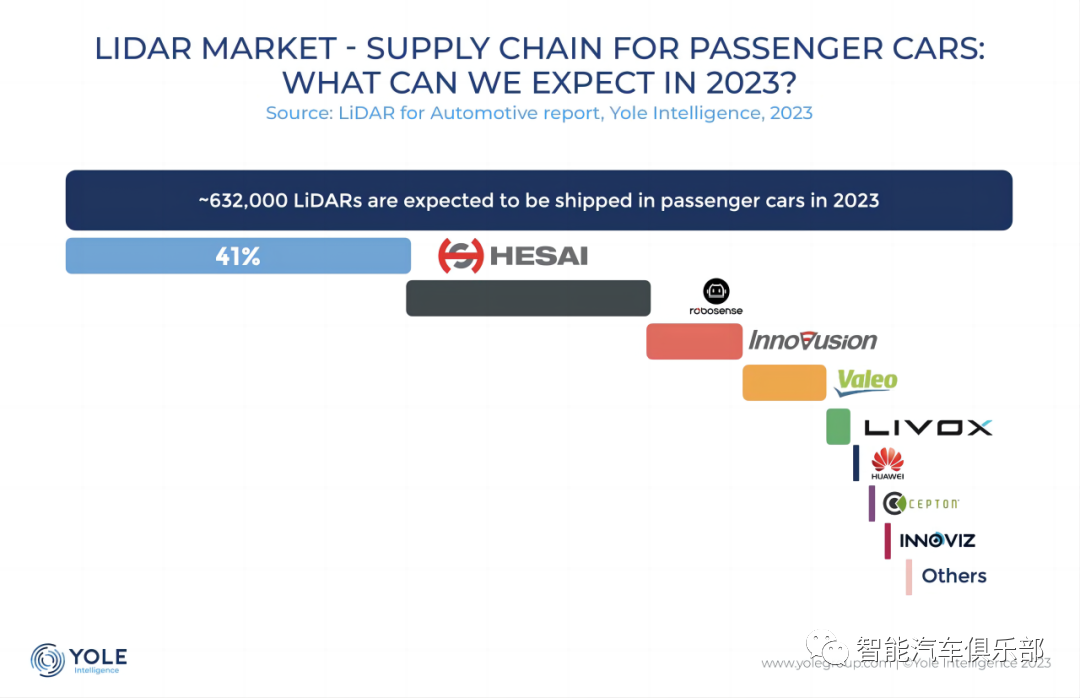

2022年,市场发生了巨大变化,此前相对不为人知的Innovusion创下了新高,向蔚来交付了超过56,000台激光雷达。法雷奥与 Innovusion 接近,体积差异仅几百个单位。

In 2022, the market changed dramatically as Innovusion, which was relatively unknown before, set a high mark with more than 56,000 LiDARs shipped to Nio. Valeo was close to Innovusion, and the volume difference was only a few hundred units.

最显着的变化之一是排名第三的禾赛的加入,以及排名第四的RoboSense。这些中国公司2022年才开始批量出货,并与大多数中国整车厂建立了合作伙伴关系。

One of the most significant changes was the entry of Hesai, ranked 3rd, and the 4th place of RoboSense. These Chinese companies only started to ship in volume in 2022 and have partnerships with most Chinese OEMs.

由于与小鹏汽车的合作,其余参与者与 Livox 分享了最后 11% 的市场份额,其中 Livox 占据了 8% 的市场份额。

The remaining players share the final 11% of the market with 8% for Livox due to their partnership with XPeng.

2023年,禾赛和速腾聚创有望引领乘用车激光雷达市场,占据前两名。这对中国玩家来说是一个巨大的胜利,但法雷奥仍然保持着良好的状态,因为它已就 Scala 3 获得了 10 亿美元的订单。

In 2023, Hesai and RoboSense are expected to lead the LiDAR market for passenger cars, taking the first two places. This is a big win for Chinese players, but Valeo is still in good shape as it communicated on a one billion dollar order for their Scala 3.

激光雷达技术不断发展的前景

THE EVEREVOLVING LANDSCAPE OF LIDAR TECHNOLOGY

在技术方面,在Yole关注的四个类别中,只有一个类别预计在未来十年内大致保持不变。

In terms of technology, among the four categories we are following, only one is expected to remain roughly the same over the next ten years.

而其他三个方面,成像技术、发射器类型和所用光电探测器类型都将有重大发展。波长是唯一保持稳定的东西。

In the three others, we could see significant evolutions regarding the imaging technology, the type of emitter, and the kind of photodetector used.

2023年,近红外(NIR)波长(905/940nm)预计将占乘用车激光雷达出货量的84%。在接下来的十年里,近红外和短波红外(SWIR)之间的比例预计将保持不变。

The wavelength is the only thing to remain stable. In 2023, near-infrared (NIR) wavelength (905 / 940nm) is expected to represent 84% of LiDAR volume for passenger cars. In the next ten years, the ratio between NIR and short-wave infrared (SWIR) is expected to remain constant.

关于成像技术,基于旋转镜的混合固态激光雷达占主导地位,预计2023年的出货量占比将达到68%,其次是基于MEMS的激光雷达,占30%。

Regarding the imaging technology, hybrid solid-state LiDAR based on a rotating mirror dominates with 68% of volumes expected in 2023, followed by MEMS-based LiDAR with 30%.

在未来的十年里,基于旋转镜的激光雷达的份额仍将达56%。MEMS的份额预计将降至7%,但主要的区别可能是闪存激光雷达的出现,它可能在未来十年占据32%的份额。

In the next ten years, the share of LiDAR based on a rotating mirror should still be 56% by volume. MEMS share is expected to decrease to 7%, but the main difference could be the emergence of flash LiDAR which could take 32% of the volume in the next ten years.

这种变化与光发射器和光电探测器的变化有关。事实上,基于多结层的VCSEL阵列正在迅速改进,并且与SiPM或SPAD相结合,它们将能够提供无移动部件的全固态激光雷达。

This change is linked to a change in the light emitter and the photodetector.

Indeed, VCSEL arrays based on multi-junction layers are improving rapidly, and, combined with SiPMs or SPADs, they will be able to offer a fully solid-state LiDAR with no moving parts.

事实上,SiPM和SPAD比雪崩光电二极管(APD)灵敏得多。这两个组件正在取代近红外区域的APD,十年内SiPM和SPAD将分别占60%和22%。

Indeed, SiPMs and SPADs are much more sensitive than avalanche photodiodes (APD). These two components are replacing APD in the NIR region, with 60% for SiPM and 22% for SPAD in ten years.

在SWIR区域,只能使用两种类型的组件:1550nm的光纤激光器和APD。这种波长的优点与眼睛安全和更长探测范围有关,但这是有代价的。其功耗大约在30W左右,而近红外激光雷达的功耗在10W到15W之间。

In the SWIR region, only two types of components can be used: a fiber laser at 1,550nm and an APD. The advantages of this wavelength are linked to eye safety and the ability to have a longer detection range, but this comes at a price. The power consumption is roughly around 30W, while NIR LiDAR has a power consumption between 10W and 15W.

文章来源:Yole

https://www.yolegroup.com/product/report/lidar-for-automotive-2023/

Recommended activity one:第三届激光雷达创新技术及产业链技术论坛(9月5日 深圳)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Roundtable: Topic planning 多感知传感器激光雷达,摄像头,毫米波,超声波分别的挑战和机遇? 激光的发展趋势和技术瓶颈,以及低成本方案可行性? 激光雷达技术路径,目前技术的现状和技术发展方向? 结合特斯拉摄像头战略聊一聊激光雷达的发展机遇和挑战? 激光雷达是感知主力还是冗余备胎? |

|

The original article was posted on the WeChat official account "Smart Car Club."Yole最新预测:2028年全球汽车激光雷达市场将达46.5亿美元,乘用车复合年增长率69%

Welcome to join us.Aibang lidar industry communicationThere are currently 2,700 people, including relevant persons in charge from major lidar manufacturers and OEMs. Click on the tags below to filter

Lidar OEM Autonomous Driving application terminal laser VCSEL light detector sensor Optical element Optical module filter Galvanometer Optical components radome cover adhesive Electronic component semiconductor chip tier1 Parts Non-standard automation Hardware circuit board motor Coating Coating equipment Plastic Products vehicle electronics Surface treatment auto parts equipment Testing Equipment Connector plastic Material software trading acting College graduate School other

Download: